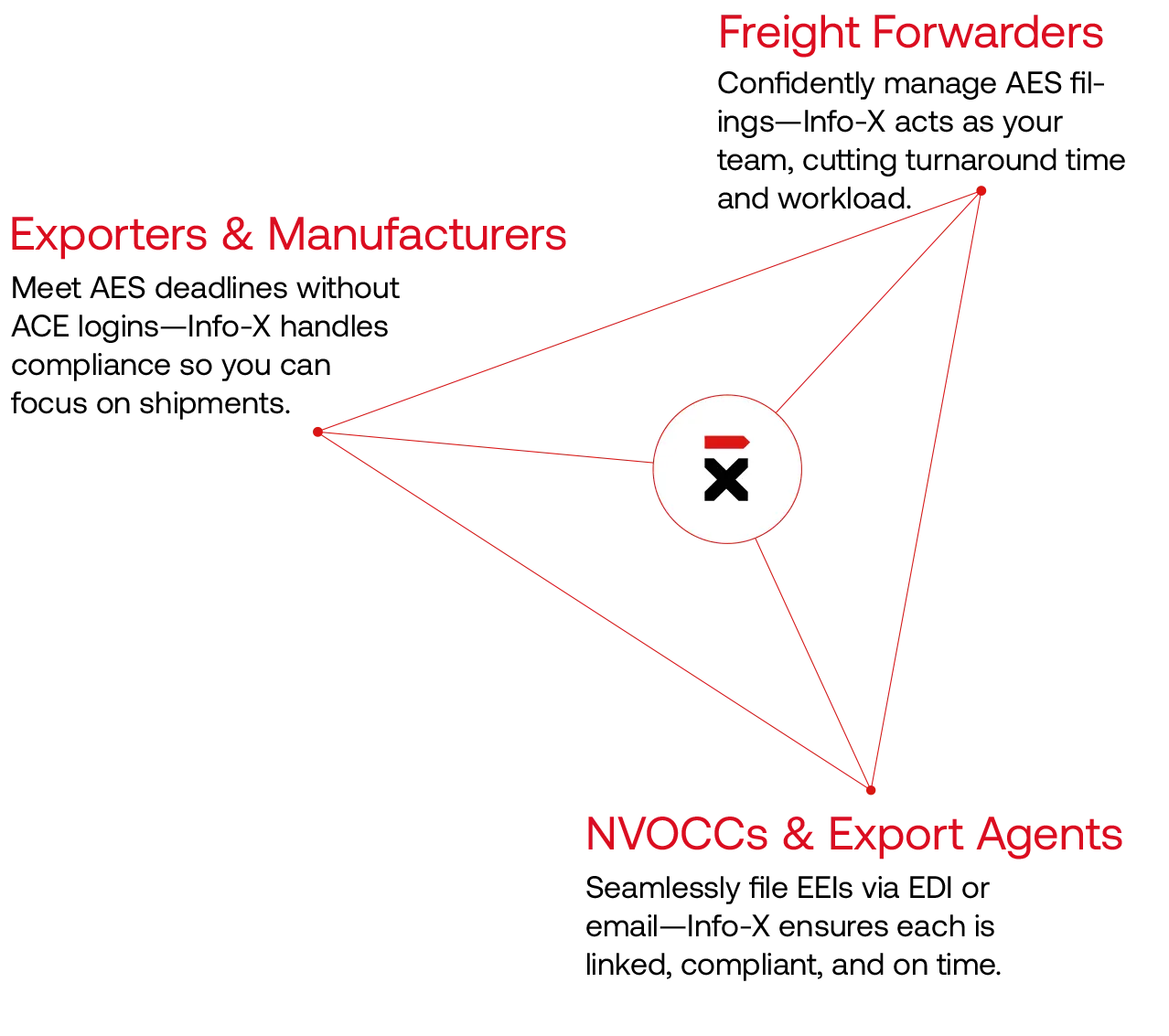

AES Filing for

US Exports

Quick, Compliant & Cost-Effective

Info-X files your Electronic Export Information (EEI) via AESDirect, delivering instant ITN confirmations with expert oversight and low per-filing costs.

Why AES Filing Matters for

Why AES Filing Matters for